TL;DR

- Stable U.S. issuance: November raised $18.8B across 58 deals, with IPOs delivering +18.8% day-1 performance and follow-ons adding $16.4B at a 6% discount.

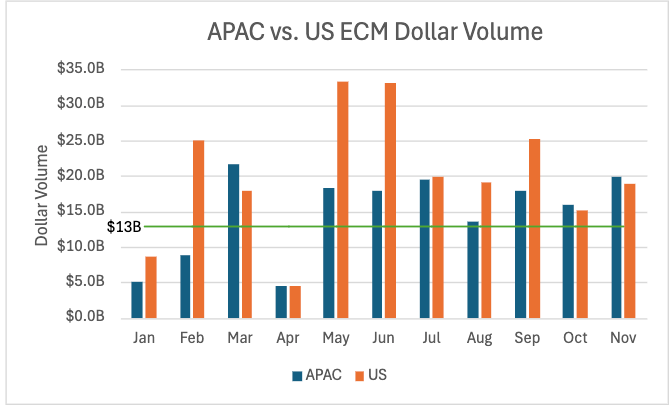

- APAC momentum: The region logged its seventh straight month above $13B, a run last seen in 2021.

- LATAM rebound: $2.9B across 5 deals marked its strongest month since July 2024, ending a three-month stretch with no offerings greater than $50M.

- Healthcare leads again: 28 deals raised $5.6B, its third consecutive month as the top U.S. sector and third straight month above $5B, with +8.4% dollar-weighted day-1 returns.

- Lock-ups ahead: 50 expirations arriving in December, nearly half in Healthcare, set the stage for elevated secondary supply into year-end.

Steady U.S issuance levels

U.S. markets in November remained stable, with $18.8B raised across 58 offerings. Of these, 7 IPOs represented $2.4B in proceeds and delivered strong aftermarket performance, averaging +18.8% day-1 returns. The 51 follow-ons contributed the remaining $16.4B, pricing at an average 6% file-to-offer discount.

A global look: Shifts in international activity

While U.S. issuance demonstrated steady momentum into year-end, APAC continued to stand out, recording its seventh consecutive month of $13B+ in issuance—a streak last observed in 2021.

LATAM also deserves recognition after delivering a sharp rebound, posting $2.9B across 5 offerings, marking its strongest month since July 2024. This performance effectively ended the region’s three-month stretch with zero offerings greater than $50M, underscoring renewed appetite for capital deployment.

Sector spotlight: Healthcare dominance continues

Healthcare once again led U.S. issuance with 28 offerings raising $5.6B, marking:

- The third consecutive month in which Healthcare was the most active U.S. sector.

- The third straight month of $5B+ raised, a trend last seen during the period of January – March 2024.

- A dollar-weighted one-day return of +8.4%, outperforming all other sectors.

For weekly ECM commentary and monthly, quarterly, and annual recaps, follow CMG’s LinkedIn page. As noted in our October report, we flagged the upcoming lock-up expiration for notable outperformer Hinge Health (+40.1%). Following its lock-up expiration, Hinge Health (HNGE) priced two secondary blocks in November totaling $189M, further contributing to sector activity.

Lock-ups ahead

Looking ahead, 50 lock-ups are set to expire in December, with nearly half tied to Healthcare, positioning the sector for continued secondary flow into year-end.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.