TL;DR

- ECM Resilience: August 2025 marked the fourth consecutive month with U.S. ECM volumes above $19B (+26% YoY).

- IPO Comeback: Six IPOs >$50M raised $3.3B, breaking a three-year August drought; Bullish and Firefly Aerospace led with strong debuts.

- Follow-On Strength: 42 offerings raised $15.8B; Circle’s $1.3B deal was the largest first FO within 90 days of an IPO.

- Convertible Activity: 15 convertibles totaled $10B, a 355% YoY jump, with Coinbase accounting for ~30% of issuance.

Momentum Carries into August

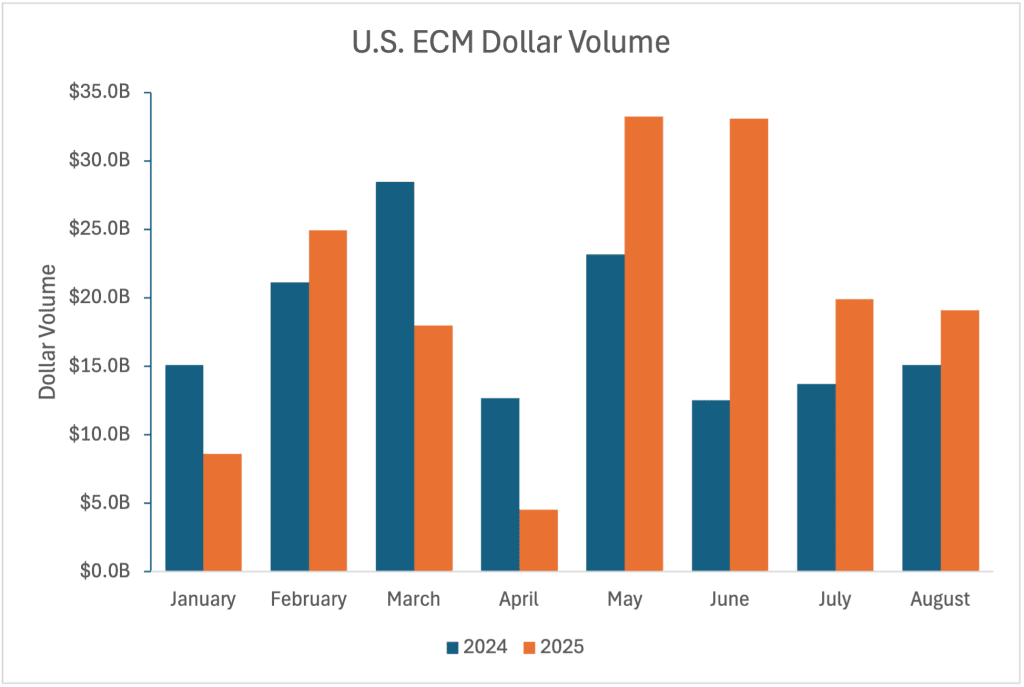

Historically a quiet month, August 2025 defied the typical market lull as issuers continued to press into favorable conditions. For the first time since 2021, ECM deal volumes topped $19.1 billion for four consecutive months, supported by robust momentum across IPOs and follow-on offerings. Activity rose sharply, with a 26.3% increase in total proceeds and an 84.6% jump in offerings compared with August 2024.

IPOs Surge, Raising $3B

IPO activity in August 2025 defied historical precedent, breaking a three-year drought for the month with six offerings above $50 million that collectively raised $3.3 billion. Often a dormant period for new issuance, August instead delivered a broad mix of deals across financials, healthcare, industrials, and technology. Performance was solid, with issuers posting a weighted 52.39% first-day gain—down from July’s record levels but still robust.

The largest dollar-weighted contributors were Bullish and Firefly Aerospace, posting first-day gains of 83.8% and 34.1%, respectively. The two IPOs contributed 69.2% of total proceeds. Importantly, every deal executed 100% of its overallotment shares, underscoring resilient investor demand across sectors.

Largest First Follow-On

42 follow-ons raised $15.8 billion – five of which were first follow-ons, most notable was Circle which wasted no time leveraging its successful IPO by returning to market with a $1.3 billion marketed follow-on just 71 days after the initial listing. The transaction represented the largest first follow-on executed within 90 days of an IPO and ranked as the 11th-quickest IPO-to-FFO among U.S. offerings above $50 million.

Convertibles Remain Constant

Convertibles took center stage in August as 15 offerings raised $10.0 billion, marking a 355% year-over-year surge compared with $2.2 billion in August 2024. Coinbase drove much of this activity, with two separate deals that contributed around 30% of total volume.

With momentum showing no signs of slowing, August’s performance underscores investor confidence and sets a favorable tone for the final stretch of 2025.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.