TL;DR

- Equity Issuance Surge – 67 offerings raised $32.5B—a 509% increase over April and the largest month-over-month surge in nominal issuance on record.

- Block Trade Dominance – 34 blocks raised $19.4B, setting a new monthly record. Unregistered blocks hit $9.2B—also a record.

- IPO Market Revival – 5 IPOs raised $2.0B with an average first-day return of 25%. All priced within/above range; 4 were upsized. MNTN and eToro surged 64.8% and 28.8%, respectively.

- Convertible Bond Rebound – 11 U.S. deals raised $10.7B—the highest monthly total YTD. 5 concurrent with follow-ons, the busiest month for such deals since Sept 2021.

- SPAC Momentum – 20 SPAC IPOs raised $4.5B in May, bringing the YTD total to 53—just two shy of the full-year 2024 total.

May marked a resurgence in equity capital markets, setting multiple records across asset classes and signaling a potential inflection point in investor sentiment.

Equity Issuance Surge

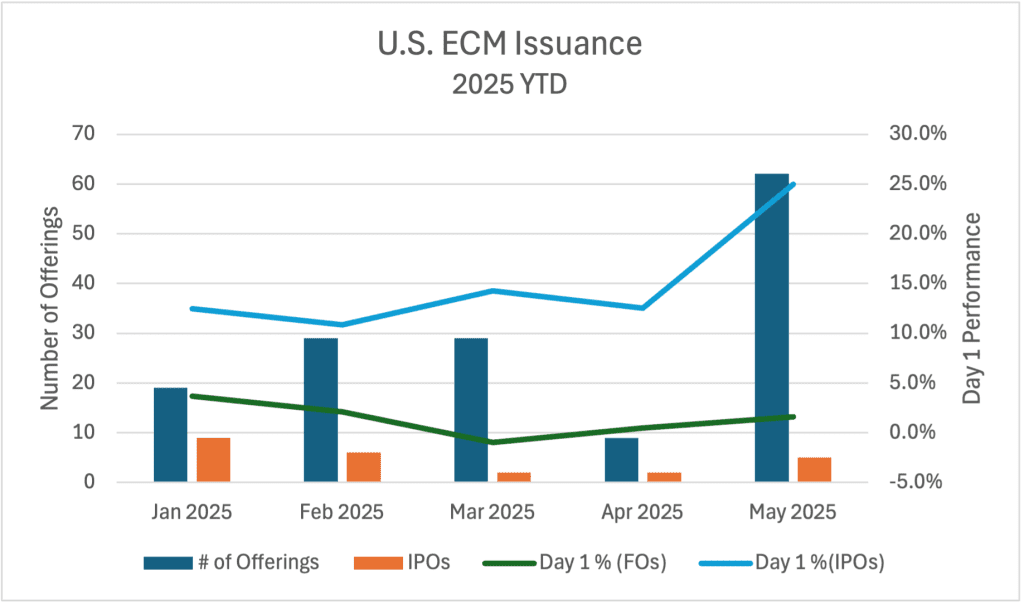

After an underwhelming start to 2025, equity issuance remained subdued through April, which closed with just 11 transactions totaling $4.5 billion—the lowest monthly deal count since August 2011 (10 deals). However, May marked a dramatic turnaround, with 67 offerings raising $32.5 billion. This represents a staggering 509% increase in volume compared to April, the largest month-over-month surge in nominal issuance on record.

Block Trade Dominance

A majority of May’s issuance came from follow-on offerings, with 62 deals raising a total of $30.6 billion. Block trades were a major driver, accounting for 59.6% of that volume. May saw 34 block trades raise $19.4 billion—the highest monthly dollar volume for blocks on record. Of these, 23 were unregistered blocks totaling $9.2 billion, also setting a new monthly record for unregistered block volume. On a dollar-weighted basis, May’s blocks outperformed those from January through April, with an average open performance of 0.32% compared to 0.07%. Additionally, the average file-to-offer discount tightened half a percentage point from 3.3% to 2.8%.

IPO Market Revival

While the IPO market has lagged for much of 2025, May indicated a larger appetite for new listings. Five IPOs raised a combined $2.0 billion, with an impressive average first-day return of 25%. All five priced within or above their expected ranges, and four upsized their offerings post-initial filing. Standout debuts included MNTN, Inc. and eToro Group Ltd, which surged 64.8% and 28.8%, respectively, on their first day of trading.

Convertible Bond Rebound

The convertible bond market also saw a strong rebound, with 11 U.S. deals raising $10.7 billion—the highest monthly total year-to-date. Five of these were executed concurrently with follow-on equity offerings, marking the busiest month for concurrent deals since September 2021.

SPAC Momentum

SPAC IPO activity continued to gain momentum, with 20 new listings raising $4.5 billion in May. This brings the year-to-date total to 53 SPAC IPOs, just two shy of the full-year total for 2024. Q2 2025 will be the fourth consecutive quarter with 18 or more SPACs.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.